Looking for the largest stock broker in India? Uncover top brokerage firms in India, their services, market share, and how to choose the best for your investmen

Looking for the largest stock broker in india? Uncover top brokerage firms in India, their services, market share, and how to choose the best for your investment journey. Compare discount brokers, full-service brokers, brokerage fees, and more to make informed decisions. Explore options and invest wisely.

Finding the Right Fit: A Guide to India’s Top Stock Brokers

Understanding the Indian Stock Broking Landscape

The Indian stock market, a vibrant and dynamic arena, offers a plethora of opportunities for investors to grow their wealth. From seasoned traders to first-time investors exploring the world of SIPs (Systematic Investment Plans) in mutual funds, the options are vast. Navigating this landscape requires a reliable and efficient stock broker. But with so many players in the market, how do you choose the right one? This article delves into the world of stock brokers in India, helping you understand the key factors to consider and identifying some of the leading names.

The Securities and Exchange Board of India (SEBI) regulates the stockbroking industry, ensuring fair practices and investor protection. SEBI-registered brokers act as intermediaries, facilitating the buying and selling of securities on exchanges like the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). They provide trading platforms, research reports, and other services to help investors make informed decisions.

Types of Stock Brokers in India

Stock brokers in India can broadly be categorized into two main types:

- Full-Service Brokers: These brokers offer a comprehensive suite of services, including research and advisory services, wealth management, and offline trading support. They typically charge higher brokerage fees compared to discount brokers. Examples include traditional brokerage houses with a strong physical presence.

- Discount Brokers: Discount brokers focus on providing a cost-effective trading platform, primarily online. They offer minimal or no advisory services and cater to self-directed investors who are comfortable conducting their own research. Their brokerage fees are significantly lower than those of full-service brokers.

Choosing between a full-service broker and a discount broker depends on your individual needs and investment style. If you require assistance with research, investment advice, and portfolio management, a full-service broker might be a better fit. However, if you are a confident investor who prefers to manage your own investments and prioritize low costs, a discount broker could be the ideal choice.

Key Factors to Consider When Choosing a Stock Broker

Selecting the right stock broker is a crucial step in your investment journey. Here are some key factors to consider:

- Brokerage Fees: Compare the brokerage charges of different brokers, including transaction fees, account maintenance fees, and other charges. Look for transparent fee structures and understand how the fees will impact your overall returns. With the rise of discount brokers, many now offer zero brokerage on equity delivery trades.

- Trading Platform: Evaluate the user-friendliness, features, and stability of the broker’s trading platform. The platform should be intuitive, reliable, and offer the tools and resources you need to analyze the market and execute trades effectively. Mobile trading apps are increasingly important for investors on the go.

- Research and Advisory Services: If you require assistance with research and investment advice, assess the quality and comprehensiveness of the broker’s research reports, recommendations, and advisory services. Consider the expertise of the research team and their track record.

- Customer Support: Check the responsiveness and efficiency of the broker’s customer support team. Ensure that they are readily available to address your queries and resolve any issues you may encounter.

- Account Opening Process: A smooth and hassle-free account opening process is essential. Look for brokers who offer online account opening facilities and require minimal documentation.

- Security and Reliability: Ensure that the broker is SEBI-registered and has a strong reputation for security and reliability. Check for measures like two-factor authentication and data encryption to protect your account and personal information.

- Investment Options: Consider the range of investment options offered by the broker. Do they offer access to equity markets, derivatives, commodities, mutual funds, IPOs (Initial Public Offerings), and other investment products?

- Margin and Leverage: Understand the margin and leverage facilities offered by the broker and use them responsibly. Leverage can amplify both your gains and your losses.

Exploring Some Leading Stock Brokers in India

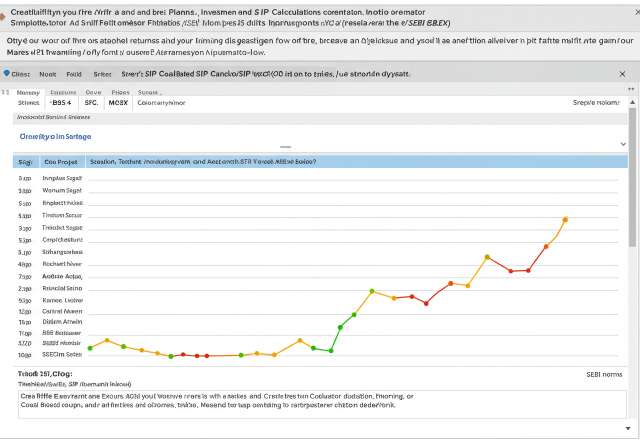

While determining the absolute “largest stock broker in india” can be complex due to fluctuating market dynamics and varying metrics (like active clients, trading volume, or revenue), several brokers consistently rank among the top players.

It’s crucial to conduct your own research and compare different brokers based on your individual needs and preferences. The information provided below is for illustrative purposes only and should not be considered as financial advice.

Popular Discount Brokers

- Zerodha: Zerodha is one of the most popular discount brokers in India, known for its low brokerage fees and user-friendly trading platform, Kite. They offer a wide range of investment options, including equities, derivatives, and mutual funds.

- Upstox: Upstox is another leading discount broker that has gained popularity for its competitive pricing and intuitive trading platform. They also offer a variety of educational resources for investors.

- Groww: Groww is known for its simplified and user-friendly interface, particularly for investing in mutual funds. They also offer direct equity investing at competitive rates.

- Angel One (formerly Angel Broking): Angel One is a well-established brokerage firm that has transitioned to a discount broking model. They offer a combination of low brokerage fees and research support.

Notable Full-Service Brokers

- HDFC Securities: HDFC Securities is a leading full-service broker that offers a comprehensive range of investment services, including research, advisory, and wealth management.

- ICICI Direct: ICICI Direct is another prominent full-service broker with a strong online presence and a wide network of branches. They offer a variety of investment options and personalized services.

- Kotak Securities: Kotak Securities is a well-known full-service broker that provides research, advisory, and portfolio management services to its clients.

- Motilal Oswal: Motilal Oswal is a leading financial services company that offers a wide range of investment products and services, including broking, wealth management, and portfolio management.

Beyond Equity: Other Investment Options Through Stock Brokers

While the primary focus is often on equity markets, remember that stock brokers often facilitate investments in a range of other financial instruments:

- Mutual Funds: Investing in mutual funds through SIPs or lump-sum investments is a popular way to diversify your portfolio and achieve your financial goals. Brokers provide access to a wide variety of mutual fund schemes.

- Initial Public Offerings (IPOs): Brokers allow you to apply for IPOs of companies that are going public.

- Derivatives (Futures & Options): For experienced traders, brokers offer access to derivatives trading, which can be used to hedge positions or speculate on market movements. However, derivatives trading carries a high level of risk.

- Bonds and Debentures: Some brokers also offer access to bonds and debentures, which can provide a more stable income stream compared to equities.

The Importance of Demat and Trading Accounts

To invest in the Indian stock market, you need two essential accounts:

- Demat Account: A Dematerialized Account (Demat Account) holds your shares and other securities in electronic form.

- Trading Account: A Trading Account is used to place buy and sell orders for securities on the stock exchange.

Most stock brokers offer both Demat and Trading accounts as a package. When choosing a broker, consider the charges associated with these accounts, such as account opening fees, annual maintenance charges, and transaction fees.

Tax Implications of Stock Market Investments

It’s essential to understand the tax implications of your stock market investments. Gains from the sale of shares are subject to capital gains tax, which can be either short-term or long-term, depending on the holding period. Investments in tax-saving instruments like Equity Linked Savings Schemes (ELSS) mutual funds, Public Provident Fund (PPF) and National Pension Scheme (NPS) can offer tax benefits under Section 80C of the Income Tax Act. Consult with a tax advisor to understand the specific tax implications of your investments.

Conclusion

Choosing the right stock broker is a critical decision that can significantly impact your investment success. By carefully considering your individual needs, investment style, and risk tolerance, you can select a broker that provides the tools, resources, and support you need to achieve your financial goals. Remember to conduct thorough research, compare different brokers, and read reviews before making a final decision. The Indian stock market offers tremendous potential for wealth creation, and with the right broker by your side, you can embark on a rewarding investment journey.