Navigate the Indian stock market with ease! Find the best stock broker company in India to suit your investment needs. Learn about brokerage charges, platforms,

Navigate the Indian stock market with ease! Find the best stock broker company in india to suit your investment needs. Learn about brokerage charges, platforms, and more to start trading confidently. Get expert insights and make informed decisions.

Choosing the Right Stock Broker Company in India for Your Investments

Introduction: Your Gateway to the Indian Stock Market

The Indian stock market, encompassing giants like the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE), offers tremendous opportunities for wealth creation. However, navigating this complex landscape requires a reliable partner: a stock broker company. Selecting the right broker is crucial for a smooth and profitable investment journey. They act as intermediaries, facilitating your trades in equity markets, derivatives, and other financial instruments. This guide will help you understand the factors to consider when choosing a stock broker company in India, ensuring you make informed decisions that align with your investment goals.

Understanding the Role of a Stock Broker

A stock broker is a SEBI-registered intermediary that enables you to buy and sell securities on the stock exchanges. They provide trading platforms, research reports, and customer support, simplifying the investment process. They are obligated to adhere to SEBI regulations, ensuring fair practices and investor protection. In essence, they are your gateway to participating in the Indian equity markets and diversifying your portfolio.

Key Services Offered by Stock Brokers:

- Trading Platform: Providing a user-friendly interface for placing buy and sell orders.

- Research and Analysis: Offering insights into market trends, company performance, and investment recommendations.

- Account Management: Assisting with account opening, KYC compliance, and transaction processing.

- Customer Support: Providing assistance and resolving queries related to trading and investments.

- Access to Various Investment Products: Facilitating investments in equities, derivatives, IPOs, mutual funds, and more.

Types of Stock Brokers in India

Stock brokers in India can be broadly classified into two categories: Full-Service Brokers and Discount Brokers. Understanding the differences between them is essential for making the right choice.

1. Full-Service Brokers

Full-service brokers offer a comprehensive suite of services, including research reports, investment advisory, personalized support, and access to a wide range of investment products. They often charge higher brokerage fees compared to discount brokers. These brokers are suitable for investors who require guidance and support in making investment decisions, especially those who are new to the stock market or prefer a more hands-on approach. They usually have a team of research analysts who provide in-depth analysis of companies and sectors, helping investors make informed choices. They may also offer portfolio management services, where they manage your investments on your behalf.

2. Discount Brokers

Discount brokers, on the other hand, focus on providing a low-cost trading platform. They typically charge significantly lower brokerage fees than full-service brokers, but offer limited or no research and advisory services. They are ideal for experienced traders who are comfortable making their own investment decisions and do not require extensive support. With the rise of technology, discount brokers have become increasingly popular in India, offering user-friendly online platforms and mobile apps for trading. They often provide access to advanced trading tools and charting software, catering to the needs of active traders.

Factors to Consider When Choosing a Stock Broker

Selecting the right stock broker involves carefully evaluating various factors to ensure they align with your investment needs and preferences.

1. Brokerage Charges and Fees

Brokerage charges are a crucial factor to consider. Compare the brokerage rates offered by different brokers and understand the different fee structures. Some brokers charge a percentage of the transaction value, while others offer flat fee plans. Consider your trading frequency and volume to determine the most cost-effective option. Also, be aware of other charges such as account maintenance fees, Demat account charges, and transaction fees.

2. Trading Platform and Technology

The quality of the trading platform is paramount. Look for a platform that is user-friendly, reliable, and offers real-time data, advanced charting tools, and seamless order execution. Mobile trading apps are also essential for trading on the go. A robust and intuitive platform can significantly enhance your trading experience and help you make timely decisions. Ensure the platform is secure and offers features like two-factor authentication to protect your account.

3. Research and Advisory Services

If you require research and advisory services, assess the quality and depth of the research reports offered by the broker. Look for brokers with a strong research team and a proven track record. Evaluate the independence and objectivity of their recommendations. If you are comfortable doing your own research, this factor may be less important. Full-service brokers typically provide detailed research reports and personalized investment advice, while discount brokers may offer limited or no research services.

4. Account Opening and Maintenance

Evaluate the ease of account opening and maintenance. The process should be straightforward and hassle-free. Check for any hidden charges or complex procedures. A good broker should provide clear and transparent information about account opening requirements and ongoing maintenance fees. Online account opening facilities and efficient customer support can make the process much smoother.

5. Customer Support and Service

Reliable customer support is essential, especially when you encounter issues or have queries. Check for the availability of different channels for customer support, such as phone, email, and live chat. Assess the responsiveness and efficiency of their support team. A broker with excellent customer service can provide timely assistance and resolve your issues quickly. Consider reading online reviews and checking their customer service ratings before making a decision.

6. Security and Reliability

Ensure the broker is SEBI-registered and adheres to all regulatory requirements. Check their reputation and track record in the industry. Look for brokers with robust security measures to protect your account and personal information. A reliable broker will prioritize the security of your funds and data. Avoid brokers with a history of regulatory violations or complaints.

7. Investment Options Offered

Consider the range of investment options offered by the broker. If you are interested in investing in mutual funds, IPOs, or other financial products, ensure the broker provides access to these options. Some brokers may specialize in certain asset classes or investment strategies. Choose a broker that offers the products and services that align with your investment goals.

Mutual Funds, SIPs, and ELSS: Investing Through Your Broker

Many stock brokers also facilitate investments in mutual funds, offering a convenient platform to diversify your portfolio. They can help you set up Systematic Investment Plans (SIPs) for disciplined investing or invest in Equity Linked Savings Schemes (ELSS) for tax benefits under Section 80C of the Income Tax Act. Your broker can guide you through the various mutual fund options available, helping you choose the ones that match your risk appetite and investment objectives. Furthermore, some brokers offer robo-advisory services, providing automated investment advice based on your financial goals.

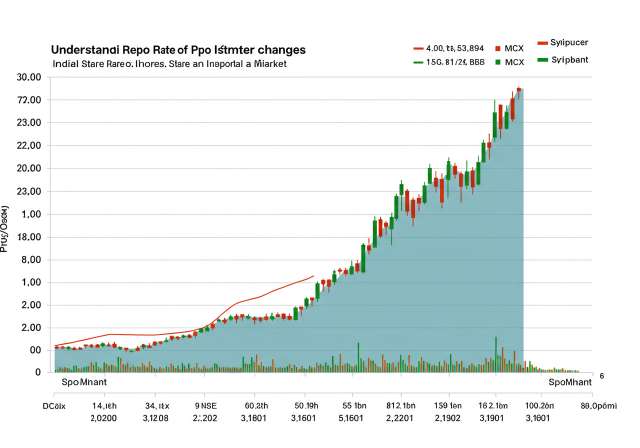

PPF and NPS: Beyond Equity Investments

While stock brokers primarily focus on equity and related investments, it’s important to remember other crucial investment avenues like the Public Provident Fund (PPF) and the National Pension System (NPS). These instruments, though not directly offered by most stock brokers, are essential components of a well-rounded financial plan, offering tax benefits and long-term savings options. Consider complementing your equity investments with these secure and tax-efficient options for a balanced portfolio.

The Importance of Demat Account

A Demat (Dematerialized) account is essential for trading in the Indian stock market. It holds your shares in electronic form, eliminating the need for physical share certificates. Your stock broker will typically facilitate the opening of a Demat account with a Depository Participant (DP) like NSDL or CDSL. Ensure the broker offers a seamless integration between your trading account and Demat account for easy transfer of shares.

Navigating the Intricacies: A Word of Caution

While the Indian stock market offers exciting opportunities, it’s essential to approach it with caution and discipline. Avoid falling prey to get-rich-quick schemes or unsolicited investment advice. Always do your own research and understand the risks involved before investing in any security. Remember that past performance is not indicative of future results. Consult with a financial advisor if you need personalized guidance.

Choosing the right stock broker company in India requires careful consideration of your individual investment needs and preferences. By evaluating factors such as brokerage charges, trading platform, research services, and customer support, you can find a broker that helps you achieve your financial goals.

Conclusion: Empowering Your Investment Journey

Selecting the right stock broker company in India is a critical step towards achieving your financial goals. By carefully evaluating your needs, comparing different brokers, and understanding the nuances of the Indian stock market, you can empower yourself to make informed investment decisions and navigate the market with confidence. Remember to prioritize security, reliability, and transparency when choosing a broker. With the right partner by your side, you can unlock the potential of the Indian stock market and build a secure financial future.