Discover the best platforms for your investments! Our guide to india top 10 stock broker options in India compares fees, features, and user experience. Choose t

Discover the best platforms for your investments! Our guide to india top 10 stock broker options in India compares fees, features, and user experience. Choose the right broker and maximize your investment potential in the Indian stock market today. Learn about brokerage charges, trading platforms, and account types available to Indian investors.

Top 10 Stock Brokers in India: A Comprehensive Guide for Investors

Introduction: Navigating the Indian Stock Market

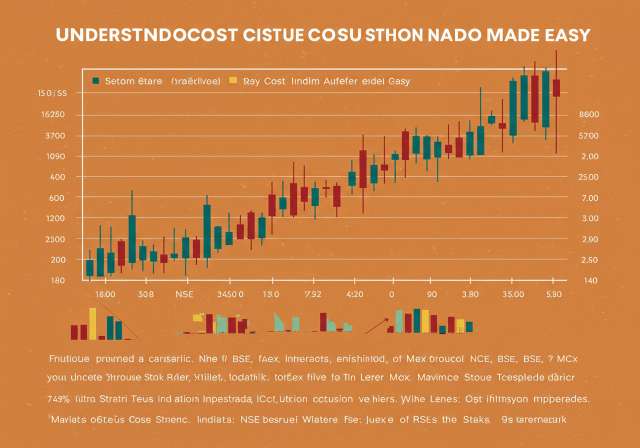

The Indian stock market, represented by the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE), offers a plethora of opportunities for investors seeking wealth creation. However, navigating this dynamic landscape requires a reliable and efficient stock broker. Choosing the right broker is crucial, as they act as intermediaries, providing access to trading platforms, research, and other essential services. With numerous options available, selecting the right one can be daunting. This article provides a comprehensive overview of some of the top stock brokers in India, helping you make an informed decision based on your investment needs and preferences.

Understanding Your Needs as an Investor

Before diving into the list of top brokers, it’s essential to understand your specific investment requirements. Consider the following factors:

- Investment Style: Are you a frequent trader, a long-term investor, or somewhere in between?

- Investment Products: Are you interested in trading equity shares, derivatives (futures and options), commodities, or currency pairs? Do you invest in mutual funds, IPOs, or other investment products like Sovereign Gold Bonds?

- Trading Platform: Do you prefer a desktop-based trading platform, a mobile app, or both?

- Brokerage Charges: Are you looking for a discount broker with low fees or a full-service broker with comprehensive research and advisory services?

- Customer Support: Do you require dedicated relationship manager support or are you comfortable with online and phone-based assistance?

- Account Opening Process: How easy and quick is the account opening process?

- Additional Features: Consider features such as margin trading, access to research reports, educational resources, and advanced charting tools.

Top 10 Stock Brokers in India: A Detailed Overview

Here’s a detailed look at some of the leading stock brokers in India, considering factors like brokerage charges, trading platforms, customer support, and more. Note that brokerage charges are subject to change, so it’s always advisable to check the latest fees on the broker’s website.

1. Zerodha

Zerodha revolutionized the Indian broking industry with its discount brokerage model. They are known for their low brokerage fees and user-friendly trading platform, Kite. They offer trading in equity, derivatives, commodities, and currency. Zerodha also provides access to mutual funds through its Coin platform.

- Brokerage: ₹0 for equity delivery trades; ₹20 or 0.03% (whichever is lower) for intraday and F&O trades.

- Platforms: Kite (web and mobile), Coin (mutual funds).

- Pros: Low brokerage, user-friendly platform, direct mutual fund investments.

- Cons: Limited research reports, no dedicated relationship manager.

2. Upstox

Upstox is another popular discount broker known for its technologically advanced platform and competitive pricing. They offer trading in equity, derivatives, commodities, and currency. Upstox also provides access to digital gold investments.

- Brokerage: ₹0 for equity delivery trades; ₹20 or 0.05% (whichever is lower) for intraday and F&O trades.

- Platforms: Upstox Pro (web and mobile).

- Pros: Competitive pricing, advanced trading platform, easy account opening.

- Cons: Limited research reports, customer service can be slow at times.

3. Angel One

Angel One, formerly known as Angel Broking, is a full-service broker that offers a combination of discount brokerage and advisory services. They provide trading in equity, derivatives, commodities, and currency, along with research reports and investment recommendations. They have a wide network of branches across India.

- Brokerage: Variable, depending on the plan. They offer both fixed brokerage and percentage-based brokerage plans.

- Platforms: Angel Broking App, Angel Speed Pro (desktop).

- Pros: Research reports, advisory services, wide network of branches.

- Cons: Brokerage charges can be higher compared to discount brokers.

4. ICICI Direct

ICICI Direct is a leading full-service broker backed by ICICI Bank. They offer a comprehensive suite of investment products, including equity, derivatives, mutual funds, IPOs, and fixed deposits. ICICI Direct provides research reports, investment recommendations, and access to international markets.

- Brokerage: Variable, depending on the plan.

- Platforms: ICICI Direct Trade Racer (desktop), ICICI Direct Mobile App.

- Pros: Wide range of investment products, research reports, banking integration.

- Cons: Higher brokerage charges compared to discount brokers.

5. HDFC Securities

HDFC Securities is another prominent full-service broker associated with HDFC Bank. They offer a wide range of investment products, including equity, derivatives, mutual funds, IPOs, and insurance. HDFC Securities provides research reports, investment recommendations, and access to various trading tools.

- Brokerage: Variable, depending on the plan.

- Platforms: HDFC Securities Mobile Trading App, HDFC Securities ProTerminal (desktop).

- Pros: Wide range of investment products, research reports, banking integration.

- Cons: Higher brokerage charges compared to discount brokers.

6. Kotak Securities

Kotak Securities is a full-service broker backed by Kotak Mahindra Bank. They offer trading in equity, derivatives, mutual funds, IPOs, and fixed deposits. Kotak Securities provides research reports, investment recommendations, and access to various trading tools.

- Brokerage: Variable, depending on the plan.

- Platforms: Kotak Stock Trader (web and mobile), KEAT Pro X (desktop).

- Pros: Wide range of investment products, research reports, banking integration.

- Cons: Higher brokerage charges compared to discount brokers.

7. 5paisa Capital

5paisa Capital is a discount broker that offers a flat fee brokerage model. They provide trading in equity, derivatives, commodities, and currency. 5paisa Capital also offers access to mutual funds and insurance products.

- Brokerage: ₹20 per order for all segments.

- Platforms: 5paisa Mobile App, Trader Station (desktop).

- Pros: Flat fee brokerage, wide range of investment products.

- Cons: Limited research reports.

8. Groww

Groww is a popular platform known for its user-friendly interface and focus on mutual fund investments. They also offer trading in equity, IPOs, and US stocks. Groww is known for its simplified investment process, making it suitable for beginners.

- Brokerage: ₹0 for equity delivery trades; ₹20 or 0.05% (whichever is lower) for intraday and F&O trades.

- Platforms: Groww App (mobile).

- Pros: User-friendly interface, focus on mutual funds, easy investment process.

- Cons: Limited features for advanced traders.

9. Motilal Oswal

Motilal Oswal is a well-established full-service broker that offers a wide range of investment products and services, including equity, derivatives, commodities, mutual funds, and portfolio management services (PMS). They provide extensive research reports and advisory services.

- Brokerage: Variable, depending on the plan.

- Platforms: MO Trader (web and mobile), MO Investor (mobile).

- Pros: Extensive research reports, advisory services, portfolio management services.

- Cons: Higher brokerage charges compared to discount brokers.

10. Sharekhan

Sharekhan is a full-service broker with a strong presence in the Indian broking industry. They offer trading in equity, derivatives, commodities, and currency, along with research reports and investment recommendations. They have a wide network of branches and a user-friendly trading platform.

- Brokerage: Variable, depending on the plan.

- Platforms: Sharekhan App, Trade Tiger (desktop).

- Pros: Wide network of branches, research reports, user-friendly platform.

- Cons: Brokerage charges can be higher compared to discount brokers.

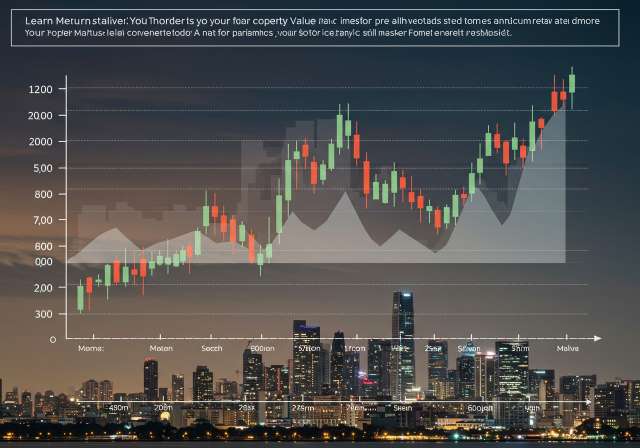

Discount Brokers vs. Full-Service Brokers

Choosing between a discount broker and a full-service broker depends on your investment needs and preferences. Discount brokers offer lower brokerage charges and are suitable for investors who are comfortable making their own investment decisions. Full-service brokers, on the other hand, provide research reports, advisory services, and a wider range of investment products, but typically charge higher brokerage fees.

Key Considerations Before Choosing a Broker

Before finalizing your choice, consider the following key points:

- Regulatory Compliance: Ensure that the broker is registered with SEBI (Securities and Exchange Board of India) and complies with all regulatory requirements.

- Brokerage Plans: Carefully compare the brokerage plans offered by different brokers and choose the one that best suits your trading style and investment frequency.

- Trading Platform: Test the trading platform and ensure that it is user-friendly and offers the features you need.

- Customer Support: Check the quality of customer support and ensure that it is responsive and helpful.

- Account Maintenance Charges: Be aware of any account maintenance charges or other hidden fees.

- Security: Evaluate the security measures implemented by the broker to protect your account and data.

Investing Beyond Stocks: Other Options for Indian Investors

While choosing the right stock broker is important for direct equity investments, remember that portfolio diversification is key. Indian investors have access to several other investment instruments, including:

- Mutual Funds: Diversified investment vehicles managed by professional fund managers. You can invest through Systematic Investment Plans (SIPs) for regular, smaller investments.

- Exchange Traded Funds (ETFs): Similar to mutual funds but traded on the stock exchange like individual stocks.

- Public Provident Fund (PPF): A long-term savings scheme with tax benefits, offered by the government.

- National Pension System (NPS): A retirement savings scheme with tax benefits.

- Equity Linked Savings Scheme (ELSS): Tax-saving mutual funds with a lock-in period of 3 years.

- Fixed Deposits (FDs): Relatively safe investment option offered by banks and financial institutions.

- Sovereign Gold Bonds (SGBs): Government securities denominated in gold, offering a safe way to invest in gold.

Conclusion: Choosing the Right Broker for Your Financial Journey

Selecting the right stock broker is a crucial step in your investment journey. By carefully considering your investment needs, comparing the features and fees of different brokers, and understanding the regulatory landscape, you can make an informed decision that will help you achieve your financial goals. Remember to always do your own research and consult with a financial advisor before making any investment decisions. Happy investing!