Looking for the best stock broker in India? This comprehensive guide analyzes top brokerage firms, comparing fees, platforms, customer service, and investment o

Choosing the Right Broker: Your Guide to Stock Trading in India

Looking for the best stock broker in India? This comprehensive guide analyzes top brokerage firms, comparing fees, platforms, customer service, and investment options to help you make an informed choice. Find India’s best stock broker for your trading needs.

Investing in the Indian stock market can be a rewarding journey. The potential for wealth creation is significant, especially considering India’s robust economic growth. However, to successfully navigate the market and achieve your financial goals, selecting the right stock broker is crucial. A good broker provides you with the necessary tools, research, and support to make informed investment decisions. With the rise of discount brokers and sophisticated trading platforms, the options can seem overwhelming. This article aims to demystify the process, helping you find the perfect fit for your investment style and needs.

Before diving into the list of brokers, take a moment to assess your individual requirements. Consider these key factors:

The Indian brokerage industry can be broadly categorized into two main types:

Full-service brokers offer a wide range of services, including:

Examples of full-service brokers include traditional brokerage houses like ICICI Direct, HDFC Securities, and Kotak Securities. These brokers typically charge higher brokerage fees, often based on a percentage of the transaction value.

Discount brokers focus on providing a low-cost trading platform, primarily online. They generally offer:

Popular discount brokers in India include Zerodha, Upstox, Angel One, and Groww. They have revolutionized the Indian brokerage industry by making stock trading more accessible and affordable.

Selecting the right stock broker requires careful consideration of several factors. Here’s a detailed breakdown:

Brokerage fees are the most obvious cost associated with trading. Understand the fee structure clearly. Is it a percentage-based fee, a flat fee per trade, or a subscription model? Also, be aware of other charges like:

Carefully compare the total cost of trading across different brokers to find the most cost-effective option for your trading volume.

The trading platform is your window to the stock market. It should be user-friendly, reliable, and equipped with the necessary tools for analysis and execution. Look for features like:

Many brokers offer demo accounts or trial periods. Take advantage of these opportunities to test the platform and ensure it meets your needs.

If you rely on research and analysis to make investment decisions, choose a broker that provides comprehensive research reports, stock recommendations, and market insights. Look for:

Remember to critically evaluate the research reports and conduct your own due diligence before making any investment decisions.

Reliable customer service is essential, especially when you encounter technical issues or have questions about your account. Look for brokers that offer multiple channels of support, such as:

Check online reviews and forums to get an idea of the broker’s customer service reputation.

The account opening process should be straightforward and hassle-free. Most brokers offer online account opening, which requires you to submit KYC (Know Your Customer) documents like your PAN card, Aadhaar card, and bank account details. You will also need to open a demat account, which is used to hold your shares in electronic form. Ensure that the broker offers a seamless integration between the trading account and the demat account.

Choose a broker that is regulated by SEBI and adheres to the highest standards of security and compliance. Look for features like:

Avoid brokers that are not regulated or have a history of regulatory violations.

Here’s a brief overview of some of the popular stock brokers in India:

While choosing the right broker is essential for stock trading, it’s also important to consider your overall investment portfolio. Diversifying your investments across different asset classes can help reduce risk and enhance returns. Consider exploring other investment options like:

Choosing the right stock broker is a crucial step towards achieving your financial goals. By carefully evaluating your needs, comparing different brokers, and considering the factors discussed in this article, you can find the perfect fit for your investment style and risk tolerance. Remember to prioritize security, transparency, and reliable customer service. The Indian stock market offers immense opportunities, and with the right broker by your side, you can embark on a successful and rewarding investment journey.

Introduction: Navigating the Indian Stock Market

Understanding Your Needs as an Investor

- Investment Style: Are you a long-term investor focused on fundamental analysis, or a short-term trader relying on technical indicators? Your investment style dictates the type of platform, research, and tools you’ll need.

- Investment Amount: Are you starting with small investments (₹1000 – ₹5000 per month) or do you plan to invest larger sums? Brokerage fees can significantly impact your returns, especially for smaller trades.

- Investment Products: Do you plan to invest solely in equity shares, or are you interested in exploring other asset classes like derivatives (futures & options), commodities, or currency trading? Not all brokers offer access to all markets.

- Trading Frequency: How often do you anticipate trading? Frequent traders should prioritize brokers with low brokerage fees and advanced trading platforms.

- Level of Support: Are you a beginner who needs extensive guidance and support, or an experienced trader who prefers minimal intervention?

Types of Stock Brokers in India

Full-Service Brokers

- Research & Advisory: In-depth market analysis, stock recommendations, and personalized investment advice.

- Relationship Managers: Dedicated professionals who provide support and guidance.

- Wide Range of Investment Products: Access to equities, derivatives, IPOs, mutual funds, bonds, and other investment options.

- Offline Trading: Option to trade through phone or in-person at branch offices.

Discount Brokers

- Lower Brokerage Fees: Significantly lower brokerage charges compared to full-service brokers, often a flat fee per trade or a subscription-based model.

- Online Trading Platform: User-friendly and feature-rich online trading platforms for web and mobile.

- Limited Research & Advisory: Minimal or no research and advisory services.

- DIY Approach: Suited for investors who are comfortable conducting their own research and making investment decisions.

Key Factors to Consider When Choosing a Broker

Brokerage Fees and Charges

- Securities Transaction Tax (STT): A tax levied by the government on transactions in the stock market.

- Goods and Services Tax (GST): Applicable on brokerage fees and other services.

- SEBI Turnover Fees: Fees charged by the Securities and Exchange Board of India (SEBI) for regulating the market.

- Stamp Duty: Applicable on certain transactions like transfer of shares.

- DP Charges: Depository Participant (DP) charges for holding securities in your demat account.

Trading Platform and Technology

- Real-time Data: Access to live market prices and data.

- Charting Tools: Advanced charting capabilities for technical analysis.

- Order Types: Availability of various order types (market orders, limit orders, stop-loss orders, etc.).

- Mobile App: A robust and feature-rich mobile app for trading on the go.

- Alerts & Notifications: Customizable alerts and notifications to track price movements and other events.

Research and Analysis Tools

- Fundamental Analysis Reports: In-depth analysis of company financials, industry trends, and macroeconomic factors.

- Technical Analysis Reports: Analysis of price charts, trading patterns, and technical indicators.

- Company News and Updates: Real-time news and updates on companies listed on the NSE and BSE.

- Investment Recommendations: Buy, sell, and hold recommendations from the broker’s research team.

Customer Service and Support

- Phone Support: Toll-free phone lines for immediate assistance.

- Email Support: Email support for less urgent queries.

- Live Chat Support: Instant messaging support for quick resolution of issues.

- Online Help Center: Comprehensive FAQs and articles to address common questions.

Account Opening Process and Demat Account

Security and Regulation

- Two-Factor Authentication: Adds an extra layer of security to your account.

- Data Encryption: Protects your personal and financial information.

- Regular Audits: Ensures compliance with regulatory requirements.

Popular Stock Brokers in India: A Comparison

- Zerodha: A leading discount broker known for its low brokerage fees and user-friendly platform.

- Upstox: Another popular discount broker offering competitive pricing and a feature-rich mobile app.

- Angel One: A well-established broker that offers both discount brokerage and full-service options.

- Groww: A user-friendly platform that simplifies investing in stocks and mutual funds.

- ICICI Direct: A full-service broker offering comprehensive research and advisory services.

- HDFC Securities: Another full-service broker with a strong reputation and a wide range of investment products.

- Kotak Securities: A full-service broker backed by a leading bank, offering a reliable trading platform and research support.

Beyond Stock Trading: Exploring Other Investment Options

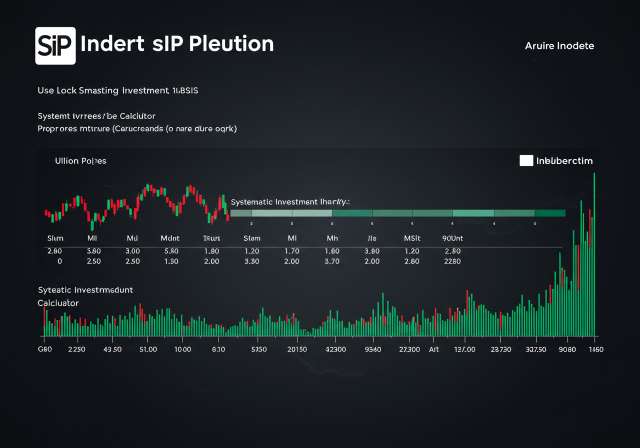

- Mutual Funds: Invest in a diversified portfolio of stocks, bonds, or other assets through professionally managed mutual funds. Options include Equity Linked Savings Schemes (ELSS) for tax saving under Section 80C, and Systematic Investment Plans (SIPs) for disciplined investing.

- Fixed Deposits (FDs): A low-risk investment option that offers guaranteed returns.

- Public Provident Fund (PPF): A long-term savings scheme with tax benefits and guaranteed returns.

- National Pension System (NPS): A retirement savings scheme with tax benefits and market-linked returns.

- Gold: A traditional investment that can act as a hedge against inflation and market volatility.