Looking for india’s best stock broker? Navigate the Indian stock market with ease! Compare top brokers, understand brokerage charges, account types, and find th

Looking for india's best stock broker? Navigate the Indian stock market with ease! Compare top brokers, understand brokerage charges, account types, and find the perfect platform for your investment journey. Start trading today!

Find India’s Best Stock Broker for Your Investment Needs

Introduction: Navigating the Indian Stock Market

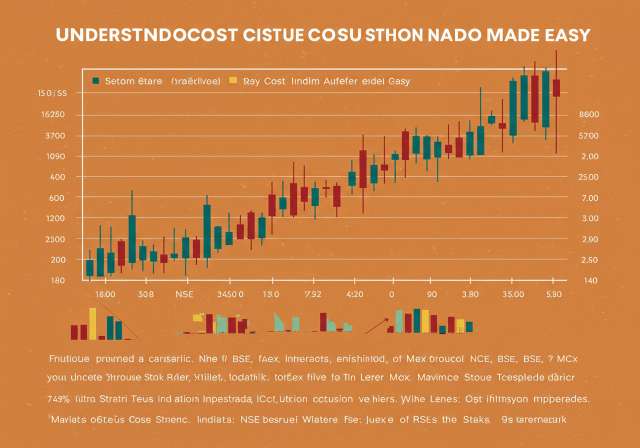

The Indian stock market offers a plethora of opportunities for investors seeking to grow their wealth. From seasoned traders to first-time investors, the key to successful investing lies in selecting the right stock broker. The broker acts as your gateway to the NSE (National Stock Exchange) and BSE (Bombay Stock Exchange), providing the platform, tools, and resources necessary to buy and sell securities. Choosing the best stock broker is crucial, impacting everything from trading costs to investment choices.

Why Choosing the Right Stock Broker Matters

Selecting a suitable stock broker isn’t merely about picking a name; it’s about aligning with a partner that complements your investment style and goals. Several factors come into play:

- Trading Platform: A user-friendly and reliable platform is essential for seamless trading. Look for features like real-time market data, charting tools, and mobile accessibility.

- Brokerage Charges: Brokerage fees can significantly impact your returns, especially for frequent traders. Understanding the different brokerage models (percentage-based, flat fee, discount brokerage) is crucial.

- Investment Options: Does the broker offer access to the investment products you’re interested in, such as equity shares, derivatives, mutual funds, IPOs, and bonds?

- Research and Analysis: Access to research reports, expert opinions, and market analysis tools can help you make informed investment decisions.

- Customer Support: Responsive and helpful customer support is invaluable, especially when you encounter issues or have questions.

- Account Types: Does the broker offer different account types (e.g., Demat account, trading account) to suit your specific needs?

- Security: The security of your funds and data is paramount. Choose a broker regulated by SEBI (Securities and Exchange Board of India) and with robust security measures.

Types of Stock Brokers in India

The Indian stock broking landscape is diverse, with different types of brokers catering to varying needs and preferences:

Full-Service Brokers

Full-service brokers offer a comprehensive range of services, including personalized advisory, research reports, wealth management, and offline trading support. They typically charge higher brokerage fees compared to discount brokers. These brokers can provide access to a wider range of investment products and personalized advice, which can be beneficial for beginners or those seeking expert guidance. Some popular full-service brokers in India include:

- ICICI Direct

- HDFC Securities

- Kotak Securities

- Motilal Oswal

Discount Brokers

Discount brokers offer a no-frills approach to trading, focusing on providing a platform for executing trades at low brokerage rates. They typically do not offer advisory services or extensive research reports. Discount brokers are ideal for experienced traders who are comfortable making their own investment decisions. The low brokerage fees can significantly reduce trading costs, especially for high-volume traders. Some popular discount brokers in India include:

- Zerodha

- Upstox

- Groww

- Angel One

Online vs. Traditional Brokers

Traditional brokers operate primarily through physical branch offices and offer offline trading support. Online brokers, on the other hand, operate exclusively online and provide access to the market through their online trading platforms. Online brokers typically offer lower brokerage fees and greater convenience compared to traditional brokers.

Key Factors to Consider When Choosing a Stock Broker

Before making a decision, consider the following factors to ensure you choose the broker that best suits your needs:

Brokerage Charges and Fees

Brokerage charges are a significant cost to consider, especially for frequent traders. Understand the different brokerage models and compare fees across different brokers. Some brokers charge a percentage of the trade value, while others charge a flat fee per trade. Also, be aware of other fees, such as account maintenance fees, transaction fees, and demat charges.

Trading Platform and User Experience

The trading platform should be user-friendly, reliable, and offer the features you need, such as real-time market data, charting tools, and order placement options. Mobile accessibility is also important for trading on the go. Look for platforms that offer a seamless and intuitive trading experience.

Investment Options and Products

Ensure the broker offers access to the investment products you are interested in, such as equity shares, derivatives (futures and options), mutual funds, IPOs, bonds, and commodities. If you plan to invest in mutual funds, check if the broker offers direct plans, which have lower expense ratios compared to regular plans.

Research and Analysis Tools

Access to research reports, expert opinions, and market analysis tools can help you make informed investment decisions. Look for brokers that offer comprehensive research reports, stock recommendations, and market insights.

Customer Support and Service

Responsive and helpful customer support is crucial, especially when you encounter issues or have questions. Check the broker’s customer support channels (e.g., phone, email, chat) and read reviews to assess their customer service quality.

Account Opening Process and Requirements

The account opening process should be simple and straightforward. Ensure you have all the necessary documents, such as your PAN card, Aadhaar card, bank account details, and address proof. Many brokers now offer online account opening, which can save time and effort.

Security and Reliability

The security of your funds and data is paramount. Choose a broker regulated by SEBI and with robust security measures, such as two-factor authentication and data encryption.

Comparing Top Stock Brokers in India

Here’s a brief comparison of some of the popular stock brokers in India, based on the factors discussed above:

| Broker | Brokerage Model | Trading Platform | Investment Options | Research & Analysis | Customer Support |

|---|---|---|---|---|---|

| Zerodha | Flat fee per trade | Kite (web and mobile) | Equity, Derivatives, Mutual Funds, IPOs | Limited research | Email, Phone |

| Upstox | Flat fee per trade | Upstox Pro (web and mobile) | Equity, Derivatives, Mutual Funds, IPOs | Limited research | Email, Phone |

| Groww | Flat fee per trade | Groww (web and mobile) | Equity, Mutual Funds, IPOs | Limited research | |

| ICICI Direct | Percentage-based | ICICI Direct (web and mobile) | Equity, Derivatives, Mutual Funds, IPOs, Bonds | Extensive research | Phone, Email, Branch support |

| HDFC Securities | Percentage-based | HDFC Securities (web and mobile) | Equity, Derivatives, Mutual Funds, IPOs, Bonds | Extensive research | Phone, Email, Branch support |

Disclaimer: This table is for informational purposes only and should not be considered as financial advice. Brokerage charges and features may vary. Please conduct your own research before making a decision.

The Role of SEBI in Regulating Stock Brokers

SEBI plays a crucial role in regulating stock brokers in India, ensuring fair practices, investor protection, and market integrity. SEBI sets guidelines for broker registration, capital adequacy, risk management, and compliance. It also investigates complaints against brokers and takes disciplinary action when necessary.

Choosing a SEBI-registered broker is essential for investor protection. You can verify a broker’s registration status on the SEBI website.

Beyond Stock Trading: Other Investment Options

While stock brokers primarily facilitate trading in equity shares and derivatives, they may also offer access to other investment options, such as:

Mutual Funds

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. Investing in mutual funds through a stock broker can be convenient, as you can manage all your investments in one place. Consider investing in SIPs (Systematic Investment Plans) for disciplined, long-term wealth creation. You can also explore ELSS (Equity Linked Savings Scheme) mutual funds for tax-saving benefits under Section 80C of the Income Tax Act.

Initial Public Offerings (IPOs)

IPOs are the first offering of shares by a private company to the public. Stock brokers provide a platform to apply for IPOs and invest in newly listed companies. IPOs can offer the potential for high returns, but they also carry significant risks.

Bonds and Debentures

Bonds and debentures are fixed-income securities that offer a fixed rate of return. Investing in bonds can provide a stable source of income and diversification to your portfolio.

Other Government Schemes

Many individuals also consider government-backed investment options such as Public Provident Fund (PPF) and National Pension System (NPS) for long-term financial planning. While these are generally not offered directly through stock brokers, understanding these options is crucial for a comprehensive financial strategy. PPF offers tax benefits and guaranteed returns, making it a popular choice for retirement savings. NPS, on the other hand, is a market-linked pension scheme that provides retirement income.

Tips for Choosing a Stock Broker

Here are some additional tips to help you choose the right stock broker:

- Define your investment goals: What are your investment objectives (e.g., long-term growth, income generation)?

- Assess your risk tolerance: How much risk are you willing to take?

- Determine your trading frequency: How often do you plan to trade?

- Read reviews and compare brokers: Research different brokers and compare their fees, features, and services.

- Consider a trial account: Some brokers offer trial accounts that allow you to test their platform before committing.

- Stay informed about market trends: Keep yourself updated on market news and trends to make informed investment decisions.

Conclusion: Finding the Perfect Fit

Choosing the right stock broker is a critical step towards achieving your financial goals. By carefully considering the factors discussed in this article, researching different brokers, and aligning your choice with your investment needs and preferences, you can find the perfect partner to navigate the Indian stock market and build a successful investment portfolio. Remember to prioritize SEBI-registered brokers for safety and regulatory compliance. While it’s difficult to definitively name the india’s best stock broker, the ideal choice depends entirely on your individual circumstances and investment style.