New to options trading in India? Discover the best option trading app for beginners with tutorial. Learn to navigate the market, understand crucial features, an

New to options trading in India? Discover the best option trading app for beginners with tutorial. Learn to navigate the market, understand crucial features, and trade smarter on the NSE & BSE.

Best Option Trading App for Beginners: A Complete Guide

Introduction to Options Trading in India

Options trading, while potentially lucrative, can seem daunting, especially for beginners. The Indian equity markets, comprising the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE), offer various options contracts on indices like Nifty 50 and Bank Nifty, as well as individual stocks. Before diving in, understanding the basics is crucial. Options are derivative contracts that give the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specified date (expiry date).

The inherent leverage in options trading can amplify both profits and losses. It’s therefore imperative to approach this market with caution, armed with adequate knowledge and the right tools. Choosing the right trading platform is a vital first step.

Why Choose the Right Trading App?

The right trading app can significantly impact your options trading journey. Here’s why:

- Ease of Use: A user-friendly interface is essential for beginners to navigate complex options chains and execute trades quickly.

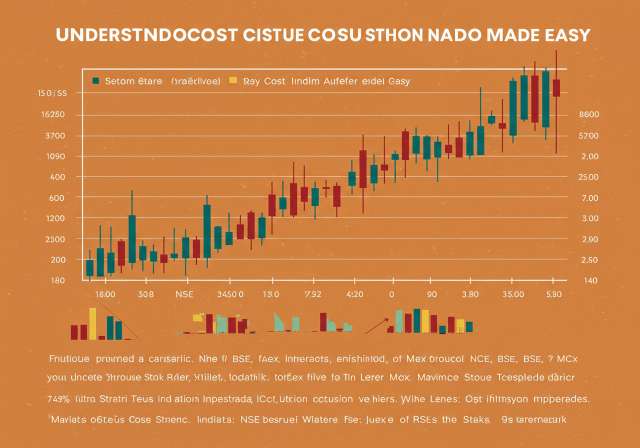

- Real-time Data: Access to real-time market data, including option prices, greeks (delta, gamma, theta, vega), and implied volatility, is critical for informed decision-making.

- Charting Tools: Robust charting capabilities help in technical analysis, identifying potential trading opportunities.

- Order Types: The availability of various order types, such as limit orders, stop-loss orders, and market orders, allows for better risk management.

- Brokerage Charges: Understanding the brokerage structure and associated fees is crucial for maximizing returns. Many brokers offer different plans, some with flat fees per trade, others with percentage-based commissions.

- Education and Support: Access to educational resources, such as tutorials, webinars, and market analysis reports, is invaluable for continuous learning.

- Security: Ensuring the platform’s security and reliability is paramount for protecting your capital. Look for features like two-factor authentication and strong encryption.

Factors to Consider When Choosing an Options Trading App

Selecting the “best option trading app for beginners with tutorial” requires careful consideration of various factors:

- User Interface (UI) and User Experience (UX): A clean and intuitive interface minimizes errors and enhances trading efficiency. Look for apps with customizable layouts and clear navigation.

- Options Chain Analysis: The app should provide a comprehensive options chain with filters to easily identify contracts based on strike price, expiry date, and premium. Features like open interest analysis and implied volatility charts are also beneficial.

- Order Execution Speed: Fast order execution is crucial, especially in volatile markets. Look for apps that offer direct market access and minimize latency.

- Risk Management Tools: Features like stop-loss orders, bracket orders, and position sizing calculators help manage risk effectively.

- Customer Support: Responsive and knowledgeable customer support is essential for resolving any issues or queries that may arise. Check for the availability of multiple support channels, such as phone, email, and chat.

- Regulatory Compliance: Ensure the app is offered by a SEBI-registered broker, providing a layer of security and investor protection.

- Mobile Accessibility: A well-designed mobile app allows you to trade on the go, monitoring your positions and executing trades from anywhere.

Top Options Trading Apps for Beginners in India (with Tutorial Features)

Several brokerage firms in India offer excellent options trading apps suitable for beginners. Here are a few popular choices, keeping in mind tutorial features and ease of use:

1. Zerodha Kite

Zerodha is a leading discount broker in India, known for its user-friendly platform and low brokerage charges. Zerodha Kite is a popular choice for beginners due to its clean interface, advanced charting tools (TradingView integration), and comprehensive options chain analysis. They provide extensive educational content, including articles, videos, and webinars, covering various aspects of options trading. Their Varsity app also offers detailed modules on financial markets. The order execution is quick, and the platform is generally stable. They have a flat ₹20 brokerage fee per executed order for options.

- Pros: User-friendly interface, advanced charting, low brokerage, comprehensive educational resources.

- Cons: Can sometimes experience glitches during periods of high market volatility.

2. Upstox Pro

Upstox is another popular discount broker that offers a feature-rich trading platform. Upstox Pro provides a user-friendly interface, advanced charting tools, and options chain analysis. They also offer educational resources and webinars to help beginners understand options trading. Upstox offers both web and mobile platforms. Upstox has a flat ₹20 brokerage fee per executed order for options.

- Pros: User-friendly interface, robust charting tools, competitive brokerage, good customer support.

- Cons: The mobile app can be resource-intensive on older devices.

3. Angel One

Angel One is a full-service broker that offers a comprehensive trading platform with various features, including options trading. Their platform offers research reports and advisory services, which can be helpful for beginners. While their brokerage charges may be slightly higher than discount brokers, they offer value-added services. They also offer a range of educational resources. Brokerage charges depend on the plan chosen, typically ₹20 per order for discount brokerage or a percentage of the turnover for full-service options.

- Pros: Comprehensive platform, research reports, advisory services, good customer support.

- Cons: Higher brokerage compared to discount brokers.

4. Groww

Groww is a popular investment platform that offers a simple and intuitive interface, making it suitable for beginners. Groww also provides educational resources, including articles and videos, to help beginners understand options trading. Their user interface is very clean and easy to navigate. They offer a flat ₹20 brokerage fee per executed order for options.

- Pros: Simple interface, easy to use, no account opening fee, educational content.

- Cons: Limited advanced features compared to other platforms.

5. 5paisa

5paisa is another discount broker that offers a flat-fee brokerage model. Their platform provides a user-friendly interface, charting tools, and options chain analysis. 5paisa provides tutorial videos and articles to educate beginners about options trading. They have a flat ₹20 brokerage fee per executed order for options.

- Pros: Flat-fee brokerage, user-friendly interface, access to research reports.

- Cons: Customer support can be slow to respond.

Tutorial: A Step-by-Step Guide to Options Trading with an App

Let’s take a look at a general tutorial for using an options trading app (using Zerodha Kite as an example, but the principles apply to most platforms):

Step 1: Account Setup and Funding

Open a Demat and trading account with a SEBI-registered broker. Complete the KYC (Know Your Customer) process and link your bank account. Fund your trading account using online methods like net banking, UPI, or IMPS.

Step 2: Navigating the App Interface

Familiarize yourself with the app’s interface. Locate the search bar, market watch, order placement screen, and portfolio section. Understand how to add stocks or indices to your watchlist.

Step 3: Accessing the Options Chain

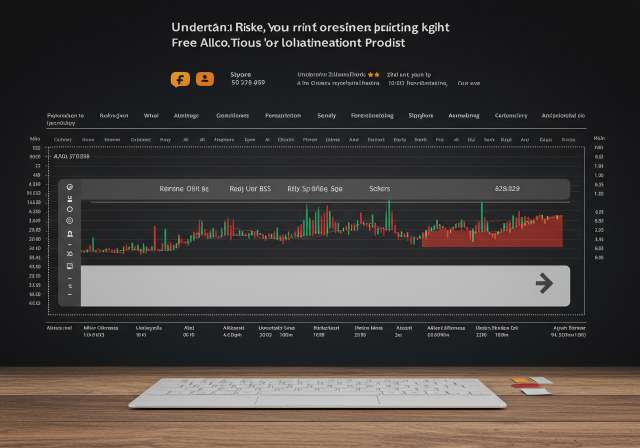

Search for the underlying asset you want to trade options on (e.g., Nifty 50, Reliance Industries). Look for the “Options Chain” or “Derivatives” section. The options chain displays all available call and put options for different strike prices and expiry dates.

Step 4: Understanding the Options Chain

The options chain shows call options (right to buy) on the left and put options (right to sell) on the right. Each row represents a different strike price. The columns display information like the Last Traded Price (LTP), bid price, ask price, open interest, and implied volatility.

Step 5: Selecting an Option Contract

Based on your market outlook (bullish or bearish), select the appropriate call or put option. Consider factors like the strike price, expiry date, and premium. In general:

- Bullish outlook: Buy a call option or sell a put option.

- Bearish outlook: Buy a put option or sell a call option.

Step 6: Placing an Order

Click on the desired option contract to open the order placement screen. Specify the quantity (lot size), order type (market, limit, stop-loss), and price (if using a limit order). Review the order details carefully before submitting.

Step 7: Monitoring Your Positions

After placing the order, monitor your positions in the “Portfolio” or “Positions” section of the app. Track the profit or loss on each position and adjust your stop-loss levels as needed.

Step 8: Exiting a Position

To exit a position, select the option contract and place a reverse order (e.g., sell a call option you previously bought). You can exit your position before the expiry date or let it expire. If the option is “in the money” at expiry, it will be automatically exercised.

Tips for Beginner Options Traders

Here are some essential tips to help you succeed in options trading:

- Start Small: Begin with a small amount of capital that you can afford to lose.

- Understand the Risks: Options trading involves significant risks. Understand the potential losses before entering any trade.

- Use Stop-Loss Orders: Always use stop-loss orders to limit your potential losses.

- Manage Your Emotions: Avoid making impulsive decisions based on fear or greed.

- Learn Continuously: Stay updated with market news, trends, and options trading strategies.

- Practice with Paper Trading: Many brokers offer paper trading accounts where you can practice options trading without risking real money.

- Consider Consulting a Financial Advisor: If you are unsure about options trading, consider consulting a qualified financial advisor.

Conclusion

Choosing the right options trading app and understanding the fundamentals of options trading are crucial for success. Remember to start small, manage your risk, and continuously learn. With the right approach and the right tools, you can navigate the options market effectively and potentially generate significant returns. Before investing in options or any other instrument, consider diversifying your portfolio with other asset classes such as mutual funds, SIPs, ELSS, PPF, and NPS to achieve a balanced risk-reward profile.